Environmental, social, and governance (ESG) is becoming more popular in business. Especially because climate change is causing affecting everything from the ways trees grow to weather patterns. But it’s also affecting the way that funds invest.

And while there is greater awareness around the climate crisis now than ever before, there is still a long way to go, even as the field of climate fintech is taking off. The United Nations has set a goal of net-zero emissions (or as close to it as possible) by the year 2050, a target that requires the participation of countries around the world. In the meantime, climate change continues to alter mountainous terrain and water infrastructure.

ESG investing is one of the catalysts that is helping to inspire action. An era of ESG investing is being ushered in by a very influential financial services industry, including portfolio managers. While fund managers are pioneering a new path and are faced with some challenges, they are also increasingly shifting their strategies to include various aspects of ESG investing.

Climate change might be a runaway train were it not for the attention paid to it by financial players. By highlighting ESG as a key component in the investment portfolio, asset managers are ensuring that sustainability remains a relevant part of the investment landscape.

In this article, we will explore the role that ESG plays in investing across sectors of the economy as well as some of the challenges the industry is facing and the bright future ahead.

Table of Contents

The Impact of Climate Change on Different Sectors and Asset Classes

Effects on Agriculture and Food Production

The Role of ESG Considerations in Portfolio Management

The Impact of Climate Change on Different Sectors and Asset Classes

While climate change is damaging to society as a whole, it affects sectors of the economy in different ways. Chief among the industries impacted by climate change is energy, given the shift from fossil fuels to renewable power. Energy is also the industry that is blamed for exacerbating the climate-change problem, with responsibility for more than 66% of greenhouse gas emissions. So, let’s focus on there.

Effects on the Energy Sector

New legislation is one of the catalysts for change in the energy sector. For example, the Biden administration has set a target for 50% of new vehicles sold in the United States to be zero-emission vehicles by 2030. This will include battery, hybrid, and fuel-cell EVs, dramatically lowering the auto industry’s reliance on fossil fuels.

Meanwhile, the Securities and Exchange Commission (SEC) has outlined a plan for companies to bolster their climate disclosures over the coming years. The proposed rules are designed to place fire under the feet of companies on climate risk disclosures, such as the direct and indirect emissions caused because of energy consumption, plus detailing the types of greenhouse gas emissions up and down the supply chain. These rules could be finalized in 2023.

Energy companies are both revamping operations and responding to government policies on environmental policies. This affects the way they do business as well as the risk controls that they must have in place internally. If they don’t make changes, they get left behind.

For example, the transition to climate change is expected to create over 10 million new jobs worldwide by 2030. Meanwhile, some 2.7 million fossil-fuel-related jobs are expected to go by the wayside in that same period due to this shift that’s already underway.

Companies that operate in the energy industry have responded to climate change in different ways as the world moves toward low-carbon technologies. Some oil and gas companies are working toward a net-zero carbon emissions standard, but it won’t happen overnight. Fossil fuel production isn’t expected to disappear altogether, but companies are seeking out alternative energy production.

Oil and gas giant ExxonMobil is among those making changes. The company has set out an ambitious plan to achieve net-zero carbon emissions by 2050 for its operations, closely aligned with the Paris Agreement’s net-zero goals. ExxonMobil has pledged to invest over $15 billion on lower-emission strategies by 2027 and is working with its partners to set similar standards. But not everybody is impressed.

Energy is far from the only sector of the economy impacted by climate change. Deloitte is behind a Vulnerability Index in which it identifies the industries whose futures are most at risk due to climate damage and the shift to net zero emissions. In addition to energy, these sectors include:

- Agriculture

- Heavy industry and manufacturing

- Transport

- Construction

These sectors are vulnerable because a large percentage of their workforces are exposed to climate extremes like heat stress. Also, they operate in capital-intensive markets where climate-related disruptions would interfere with production and investments. Finally, their income is dependent on economic growth from fossil-fuel production, which, as the firm says, is “exposed to transition risk.”

Effects on Agriculture and Food Production

The ag industry, including food production, is also directly impacted by climate change, affecting food security. Sudden changes in the climate, including rising temperatures, extreme weather events, different rain patterns, and decreases in water supply, all have the potential to interfere with ag production.

According to NASA, harmful effects from climate change could materialize in crop production by 2030. Corn and wheat are the crops that a worst-case greenhouse gas emissions scenario would most impact. Corn crop yields could fall as much as 24%, which would have “severe implications worldwide,” according to NASA scientist Jonas Jägermeyr. However, wheat yields would actually see an increase of approximately 17%.

These are just a couple of reasons the demand for sustainable farming practices is on the rise. According to SkyQuest Technology Consulting, the sustainable ag market is projected to exceed $28.5 billion by 2030, reflecting a CAGR of nearly 10% in the years leading up to the next decade. Fueling this demand in part is a need to bolster food production to provide for an explosion in the global population of 9 billion people.

Countries around the world are looking to incentivize the ag community to adopt sustainable food production practices with ESE in mind — environmentally, socially, and economically sustainable. This entails moving away from harmful pesticides and fertilizers, preventing soil erosion, and lowering water consumption with a common goal of biodiversity.

The Role of ESG Considerations in Portfolio Management

Portfolio managers are taking notice of the shift and are increasingly incorporating ESG themes into their investment strategies. In some cases, they are launching entirely new funds to fit within sustainable parameters to meet investor demand.

Indeed, ESG portfolio managers are a rising segment in the asset management industry. These investment professionals consider companies’ impact on ESG-related themes as a condition before investment.

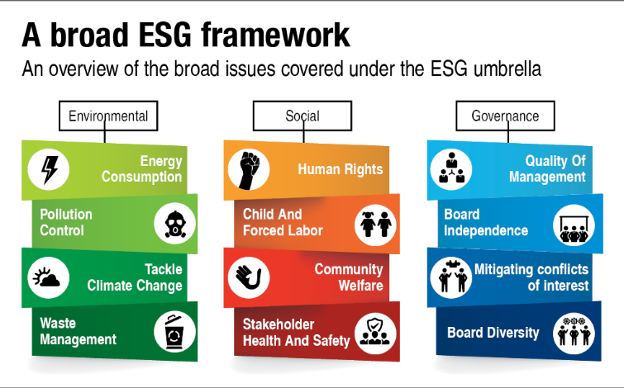

In addition to the environment, they weigh other factors like diversification among staff and on the board of directors, compensation, and transparency with investors. They monitor a management team’s progress toward stated goals on ESG issues.

Of course, strategies might also focus on companies active in climate-friendly activities, such as renewable power or water access around the world. This is a form of positive screening. Meanwhile, negative screening has to do with exclusion. It takes the approach that funds are more impactful by avoiding companies that do not prioritize sustainability, such as those that rank low in ratings assigned by companies like Moody’s or Sustainalytics.

ESG Fund Examples

When BlackRock, the largest asset manager in the world, introduced its U.S. Carbon Readiness Transition ETF, the fund manager was able to attract $1.25 billion to its coffers in a single day. BlackRock is targeting companies that it expects are poised to benefit from the shift to a low-carbon economy.

More recently, ESG funds, whose strategy involves biodiversity, experienced a 15% increase in assets in the two months leading up to March 2023. It’s a sign that the fund industry is pioneering a fresh niche within ESG despite not having a formal regulatory framework to do so. The rise in assets comes on the heels of a 150% jump last year in the number of funds dedicated to biodiversity strategies.

ESG can also affect fund returns. Take gender diversity. A report published by Vanguard reveals that “maximizing gender diversity correlates with as much as a 38.9 basis point improvement in fund performance.”

ESG Fund Risks

Not every fund that looks like an ESG portfolio is legitimate. One of the risks in this industry is a practice known as greenwashing. This is when companies provide misleading data on their sustainability efforts and misrepresent a product or service’s impact on climate change. Regulators around the world are developing stricter rules as it relates to ESG compliance to weed out greenwashing.

The U.S. SEC last year introduced a proposal for a long-standing names rule that aims to put an end to the use of fund names that are false or misleading. The regulator seeks to modernize the rule and broaden the scope for funds with investment themes in the name, such as ESG. These funds must direct at least 80% of their investments into assets that are true to that mission.

ESG rating models have yet to be regulated and instead use an industry comparison system as a standard. As a result, it’s not uncommon to find instances where a fossil-fuel company’s rating is higher than that of an EV maker. There are efforts underway to make ESG reporting more standardized for all companies across sectors. MSCI’s efforts should help.

MSCI is one of the go-to ESG rating systems in the industry. It is in the process of narrowing its model for ESG criteria, making them more stringent. Thousands of ETFs are poised to have their ratings lowered, while others will get knocked out of the rating system altogether. The number of ETFs with a top rating is expected to plummet from more than 1,100 to just over 50.

Conclusion

ESG investing is a complex landscape. However, as new funds continue to launch and more assets flow into them, it is going to become more mainstream.

Individual sectors of the economy, like energy and agriculture, are at the center of this transition to climate neutrality, one that is likely to only gain more traction amid ambitious ESG-related goals. The more that investment portfolios reflect this shift, the greater they can effectively foster sustainable financial growth and mitigate climate-related risks.

Learn more about how climate change is impacting the business and investing world, especially as climate fintech takes over.