Artificial intelligence (AI) for banks is gaining traction. The world is striving to reach ambitious climate goals for net-zero emissions by 2050 as part of the Paris Agreement. However, it’s becoming increasingly clear that making these targets is going to be more challenging than anticipated. Nevertheless, there’s still hope. The one-two punch of AI and banking innovation could help to accelerate climate fintech goals around the world.

Climate fintech is the place where sustainability and financial services meet. It’s the latest offshoot of the ESG and financial technology (fintech) market segments, and it has market participants excited about the next chapter of opportunities. As of Q4 2022, climate fintech startups had attracted $2.2 billion to their coffers, up from $1.8 billion in the prior year, demonstrating robust investor interest in this space worldwide.

Climate fintech is further broken down into multiple niches, the most popular of which is carbon accounting. This includes software solutions that help businesses to report their carbon footprints by measuring sustainable activities against relevant emissions.

The other half of this equation, AI, is one of the hottest market segments in fintech right now. It only stands to reason that it would also make its way into the climate fintech market. Banks are leading the charge in this regard, harnessing their innovation and industry data prowess in their lending and bond-issuance activities.

In this article, we will explore ways that banks are already using AI to fight climate change. In addition, we’ll look at the role of AI in the future of climate fintech, not to mention some of the challenges the industry is facing along the way.

Table of Contents

The Role of Banks in Climate Fintech

How AI Can Accelerate Climate Fintech

Future of AI in Climate Fintech

The Role of Banks in Climate Fintech

Financial institutions, with a combined market cap in the hundreds of billions of dollars, are one of the most influential sectors for thwarting climate change. First and foremost, this is this reflected in the types of products and issuances they are doing, like green bonds. However, it’s also apparent in the types of relationships they are forging and in the way they are encouraging customers to make climate-friendly decisions.

Banks are flexing their climate fintech muscles in many ways, including M&A. For example, Cincinnati’s Fifth Third Bancorp last year acquired Dividend Finance, a fintech that specializes in POS financing loans for home improvements in the renewable energy space. It’s part of the bank’s mission to reduce its carbon footprint, handle climate-fueled risks and participate in the transition to a more sustainable world.

A trend has emerged around partnerships between traditional banks and credit unions with fintechs that specialize in climate-related markets. The idea is to issue financing to companies that operate in the renewable space, such as residential solar loans.

Climate fintech is a burgeoning market segment, one in which startups depend on the financing that banks and venture capitalists bring to the table. This presents both opportunities and risks. For example, the seizure of Silicon Valley Bank (SVB) by the feds affected climate fintech companies firsthand.

SVB has been a major financier of debt to climate technology startups, propelling the growth of this market segment in recent years. Many ESG-related companies preferred to do business with SVB because of the depth of their experience and knowledge in this space.

However, a run at this bank in March 2023 left depositors unable to access their funds. Ultimately, SVB was rescued by the feds. But it serves as a stark reminder to founders in this space that they might need to establish new banking relationships.

Help is on the way. One key way banks are leveraging technology to fight climate change is through the use of blockchain technology. The transparency of a decentralized ledger such as the blockchain lends itself to activities like tracking carbon emissions and energy consumption.

The combination of AI, blockchain, and the Internet of things (IoT) has introduced a way for physical entities to “capture, validate and report impact data,” showing how activities are affecting the climate in real-time, a Barclays report reveals.

How AI Can Accelerate Climate Fintech

AI isn’t brand new, but fresh applications continue to emerge. The rise of ChatGPT is one of them. This technology makes it possible to have human-like conversations with a robot. The rise of ChatGPT has the potential to disrupt many sectors of the economy due to its ability to perform tasks like writing, researching, and gathering data.

AI is also a powerful tool in the fight against climate change. Its ability to collect and analyze data could be used to identify potential weaknesses and vulnerabilities on the path to carbon neutrality before they become disasters like the SVB debacle. Below is a list of ways in which AI can be used to accelerate fintech.

Risk Assessment and Mitigation: Banks are harnessing the AI provided by both cloud-based SaaS systems and data gathered by satellite or aircraft to direct loans based on climate risks. As a result, there’s greater transparency and awareness of loans and the risks they may present. There’s also a greater opportunity to compare sustainable-based market products against one another and provide insight into where the risks are most pronounced.

Forecasting: AI can also support the use of weather predictions, improving the timing and accuracy of weather events. AI, through the use of models, algorithms, and sensors, can help to analyze the data related to the climate and forecast weather events. In turn, banks can better understand the impact and risks of climate change in certain jurisdictions and adjust their financing accordingly.

Reporting: AI-fueled software solutions are helping to streamline and automate the carbon accounting process, equipping banks to better manage their portfolios, measure greenhouse gasses and move closer toward net-zero emissions.

Ultimately AI can support banks and investors alike in making better decisions about climate-related investments.

IV. Real-World Examples of AI in Climate Fintech

- Netherlands-based Triodos Bank is using AI to examine alternative data to create lending models designed for markets that are underbanked, as well as to underwrite and issue more green bonds.

- Major banks are using machine learning-generated data from their corporate clients to help classify financing deals for companies looking to invest in climate-friendly equipment and systems.

- On the consumer side, we’re seeing product innovation. ESG-focused investment platforms and sustainability-oriented neobanks are helping consumers to manage their money-saving, investing, etc. — in a sustainable way. Companies are building products like credit cards that place a carbon limit on transactions in an attempt to slash the carbon footprints of customers.

- Payments giant Mastercard has fintech startup Doconomy to build a carbon calculator, which shows users just how much of a carbon footprint is tied to their everyday purchases.

- Online banks like Aspiration are promising customers “fossil-fuel-free deposits.” This means that they’re refraining from directing the deposits that customers entrust the bank with for any fossil-fuel-related activities, like oil pipelines. On the positive side, Aspiration directs funds toward reforestation commensurate with the number of transactions in which customers use their bank cards.

V. Challenges and Limitations of AI in Climate Fintech

Among the innate challenges that banks face are their massive size and legacy systems. AI is a high-tech phenomenon that banks are having to integrate into their existing systems. Despite having poured billions of dollars into this transformation, it’s no easy task.

Not all banks have the strategies in place to implement AI successfully. It’s especially challenging if a bank has an insufficient technology stack to begin with, or lacks the talent to bring the institution into the technology age.

It’s incumbent upon banks to invest in and strengthen their core systems, which have served them well for lending and debt issuance in the past but don’t have the speed or scale to handle greater automation. In doing so, they can be ready to build using AI for climate finance.

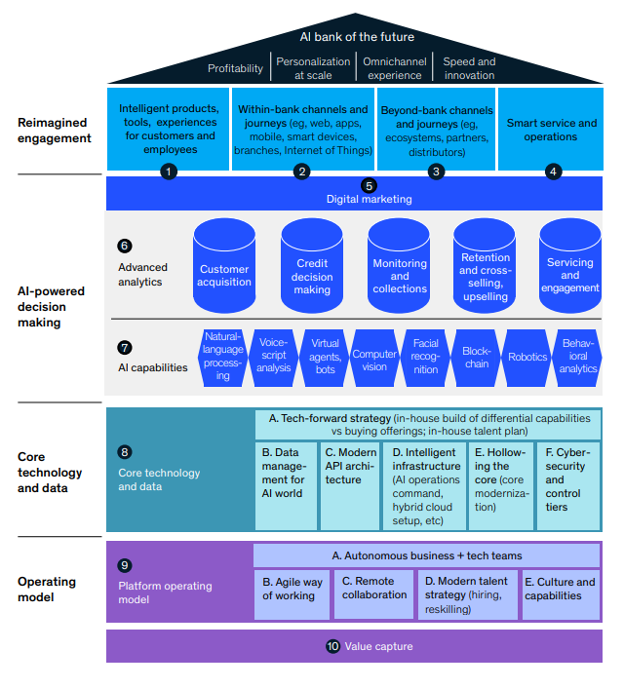

To do this, banks must take a “holistic approach” to integrate AI across four layers of the “capability stack” — customer engagement, decision making, core, and operations, according to a McKinsey report.

On the ESG side, greenwashing remains an issue where companies mischaracterize their impact on the environment or their sustainability efforts. This conundrum spills over into banking, where financial institutions have pledged to support the transition to net-zero emissions yet continue to fund fossil-fuel projects.

Future of AI in Climate Fintech

AI has only scratched the surface in banking, let alone the climate finance industry. It has the potential to transform both financial services and climate tech to deliver solutions to the climate change problem. And the thing about fintech is that innovation is happening at such a quick pace that it doesn’t wait around for the banks to catch up, paving the way for non-bank financial institutions, like neobanks, or challenger banks, to fill the gap in many ways.

The future of AI in climate fintech could take many forms, with the common themes of efficiency and sustainability. Banks and other financial services firms have a key role in this transformation, where they will be building the products and providing the financing for this AI-fueled future in climate fintech to become a reality. If they do it right, battling climate change will become a simpler and more automated part of society sooner than later.

Conclusion

In conclusion, the intersection of (AI) and banking innovation presents a promising opportunity to accelerate climate fintech goals. Climate fintech, a convergence of sustainability and financial services, has garnered significant investor interest and encompasses various niches, such as carbon accounting. Banks, with their substantial market influence, are leveraging AI to combat climate change by directing loans based on climate risks, improving weather event forecasting, automating carbon accounting processes, and making informed climate-related investment decisions. Real-world examples showcase how banks are using AI for lending models, green bonds, ESG-focused platforms, and carbon calculators. However, challenges persist, including the integration of AI into legacy systems and the risk of greenwashing.

Looking ahead, the future of AI in climate fintech holds the potential for transformative solutions, with banks playing a crucial role in driving efficiency and sustainability. At the same time, non-bank financial institutions also contribute to filling the innovation gap. By embracing AI and fintech advancements, the battle against climate change can become more streamlined and automated, bringing us closer to a sustainable future.