What is socially responsible investing, and how can banks help implement it?

When it comes to socially responsible investing, no other group has seemingly captured more of the spotlight than financial institutions. This is due to the influence that banks have in the global landscape, not only providing investment but also financing the very deals that take place in this realm, innovating with new products, and exerting their influence. Read further to learn more about implementing socially responsible investing for banks.

Table of Contents

Background on Socially Responsible Investing

Background on Socially Responsible Investing

With the Paris Agreement having targeted 2050 as the year global emissions reach net zero, environmental, social, and governance (ESG) criteria have become more urgent than ever before, including among investors. The banking community appears to be split as it pertains to SRI, in some cases going full throttle and in others hesitating to fully commit.

Some level of dedication to socially responsible practices can be found across the financial services spectrum, from community banks to major financial institutions. The Net Zero Banking Alliance (NZBA), a UN initiative under the Glasgow Financial Alliance for Net Zero (GFANZ), comes to mind. A few of the banks that help to comprise this alliance include JPMorgan, Goldman Sachs, and Bank of America. At last check, the NZBA includes more than 125 member banks across 41 countries with a total of $73 trillion in assets.

Meanwhile, corporations are increasingly expected to attach ESG disclosures to their filings, but no category is perhaps more influential than banks. This is because banks are engaged in both the public and private sectors and therefore carry a great deal of influence in the economy.

Indeed, ethical investing is not the same for every firm. The classification system for ESG is, in many ways, still being defined, and some banks appear to be more environmentally friendly than others. Banks have also proven that combating climate change can be easier said than done.

While there’s no one way that a bank implements SRI, there are certain steps that banks can take to implement more socially responsible investing behavior in their activities.

Asset Management

The way that a bank allocates capital shows its true stripes, including whether SRI is a top priority. However, their commitment to combating climate change is not only evident in the way that a bank invests but also in those assets that it avoids.

The investment thesis is two-pronged, taking both financial and environmental results into consideration. As a result, banks are demonstrating ethical investing while at the same time creating a healthier balance sheet.

The way banks can build SRI into their investments is by considering potential assets through the lens of ESG themes, which again involves not only the financial aspect but also environmental factors. This is a double-edged sword in terms of strategy.

On the one hand, it involves identifying companies or debt securities, for example, that are having a positive effect on the planet and the human race. On the other hand, it also means sidestepping companies or other assets that participate in activities that are deemed harmful to the environment or the human race, which, more times than not, leads back to fossil fuel development, like dirty coal.

One way that banks are getting better at spotting socially responsible investments is by hiring savvy ESG professionals. Banks are increasingly changing things up by bringing in climate scientists and sustainability pros and are forking out big bucks to do this. They are doing this to keep their promise to invest in a way that fights climate change.

Financing Deals

Another key way in which banks demonstrate their commitment to SRI is through the deals and regions to which they provide financing, as well as those they avoid. The capital that banks provide to other corporations and government entities helps them to grow, which is why sustainable financing is so important.

Banks perform sustainable financing in different ways, including in the debt capital markets. The European Investment Bank got the ball rolling with the maiden Climate Awareness Bond (CAB) in 2007. Since then, the market has ballooned, with governments and companies alike flocking to green bond issuance.

Individual banks are also taking the lead. Take ING Bank. The Dutch bank has vowed to increase its role in financing renewable projects by 50% by the end of 2025. By the same token, ING has committed to avoid delivering dedicated financing to fresh oil and gas projects. The bank is taking these steps to align itself with the IEA’s ‘Net Zero Emissions by 2050 Roadmap.’

Some Wall Street banks have come under fire by ESG groups for not completely distancing themselves from providing financing to the fossil fuel industry. As of 2022, U.S. banks, including JPMorgan, Citigroup, Wells Fargo, and Bank of America, represented 25% of fossil fuel financing in the previous six years, according to a report by Banking on Climate Chaos.

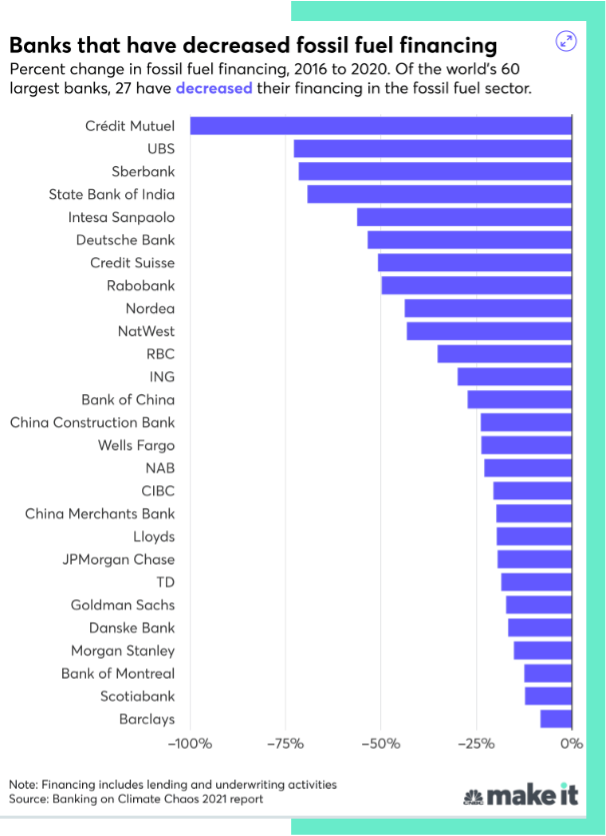

As the chart below illustrates, while dozens of banks have committed to lowering their fossil fuel financing, some are taking more of a leadership role than others. Meanwhile, European and Asian banks are further ahead of U.S. banks on this front.

Investment Products

Investment products are a key way that banks can implement socially responsible investing. Banks can offer a range of SRI products, such as SRI mutual funds and ETFs, to their customers. Investors are increasingly demanding it.

This allows customers to align their investments with their values and support companies and projects that promote social and environmental sustainability. There is a myriad of ways that banks can build sustainability into their investment products. While there has been innovation on this front, there is always room for more.

As of 2020, the size of assets managed in sustainable and ESG ETFs alone surpassed $15 trillion. The projections for the future are even more robust, with $9 trillion in fresh ESG asset inflows expected in the three years leading up to 2025. Total ESG AUM (not just ETFs) are on pace to $50 trillion by that year, Bloomberg Intelligence data reveal.

One of the hurdles to sustainable financing is insufficient regulatory guardrails and succinct standards by which to assess a sustainable investment or activity. Nevertheless, green shoots are emerging in this area, such as in sustainable lending. This is where banks factor ESG characteristics into their credit decisions, and it is gaining traction.

Sustainable lending doesn’t stop there. Banks around the world have also begun offering more attractive financing terms to issuers that hold themselves accountable for environmental issues.

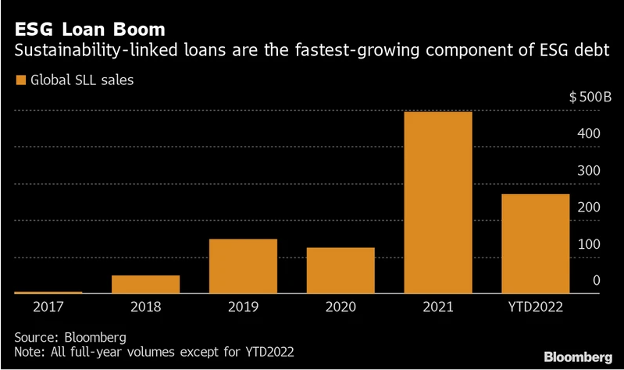

Investors are putting more pressure on banks these days when it comes to ESG matters, and this includes their lending behavior. The amount of sustainability-related lending that banks issued climbed from $5 billion in 2017 to $120 billion three years later. According to Bloomberg, in the total ESG debt market, sustainability-linked loans are growing at the fastest pace.

Flexing Their Muscle

Banks also have an opportunity to exert their influence as shareholders to engage with the management teams of the companies in which they have invested. Considering the large size of bank balance sheets, it’s not uncommon for banks or other asset management firms to be among the top shareholders in a corporation. As voting shareholders, banks can leverage this position to encourage businesses to strengthen their social and environmental practices and performance.

You could say that banks have a responsibility to guide the companies in which they have influence not only through sustainable investing but also their clientele.

Small and medium-sized businesses are highly dependent on banks for their financing. And yet many SMBs lack the tools needed to strategize for a net-zero emissions future. They could use the expertise of their larger peers.

And this cohort, SMBs, represent 99% of global businesses, so their combined efforts could certainly make a difference. On that note, this group is also responsible for 60% of the emissions into the atmosphere in a regional study. If the world is going to be successful in its shift to net-zero emissions, the SMB community is going to have to play a major part.

British banks are already stepping up to help on this front. For example, U.K. bank NatWest offers its small business customers what’s known as a carbon tracker, so they can monitor their carbon footprint. Providing businesses with this information empowers them with knowledge so that they can then take further steps toward sustainability.

Also in London, Lloyd’s Bank is behind a Green Building Tool for its business customers, through which these businesses can determine how energy efficient they are in their practices.

Conclusion

Socially responsible investing is not just a fad and is here to stay. Banks are out front in this journey toward net-zero emissions through the way that they invest, innovate, and influence. They have an opportunity to help break some of the barriers that are slowing down progress on ESG adoption.

While the exact approach toward sustainable banking may differ, a common thread should be transparency. This is key with or without the proper classification system or regulatory framework. For it to be effective, sustainable investing should be apparent in the way that banks do business, invest and support local communities.